Consumer Boomer |

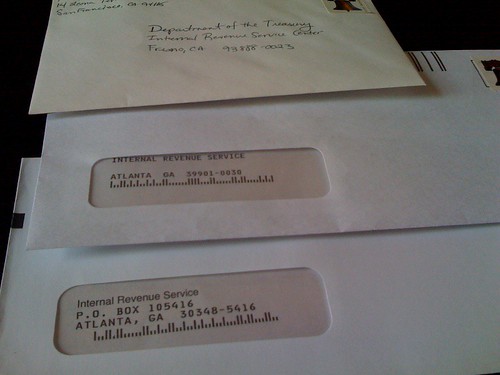

| Getting a Notice From the IRS – What to Do! Posted: 26 May 2010 04:54 AM PDT What to do When You Receive a Notice From the IRS? You go to the mailbox, pull out your mail, and Holy Craaaaaap there is a letter from the IRS … and it ain’t no check! You reluctantly open it and find it is a notice that you owe money. You are pretty sure you filled out the forms properly and legally, but is it possible that you forgot to claim something that they found out about? What will they do to you if they think you intentionally cheated? OMG!!!! What now? Going to jail or just spending the rest of your life running. First things first! Run to the house and change your under-ware before the neighbors see the brown spot! It’s not necessarily the end of the world. The IRS literally sends out millions of these notices, most for clarification of a minor issue that was either entered incorrectly, or inadvertently omitted from your return. They aren’t after you. They are after your money … the money you owe and nothing more! On the other hand, you can’t get away with just ignoring the notice. There are some very important steps you need to take when you receive such a notice. Steps to take if you receive a “Notice form the IRS” |

| You are subscribed to email updates from Consumer Boomer To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment

Thank you for commenting on my blog. I will write back soon!