Consumer Boomer |

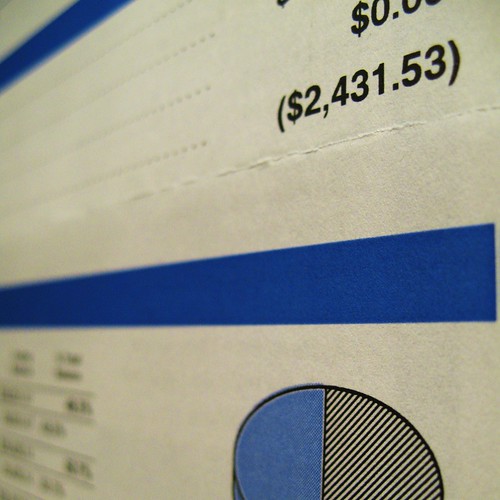

| 401k Tips Right Before You Retire Posted: 17 Aug 2010 05:36 AM PDT Individuals who use a 401k to save for retirement must understand how their plan works in order to get the most benefits offered by this type of savings plan. How you manage your 401k from the beginning will prove to be important when the time comes to withdrawal money from your account. Here we look at how the 401k works and tips to manage your account up to the point of retirement. What is a 401k?The 401k is a savings plan made available by employers. Employees can contribute to their 401k with pre-tax dollars allowing the money to grow in a tax deferred setting. Contributions can usually be used as a tax deduction when you file your income tax return. Employers also have the option of contributing or matching your contributions. The 401k is designed as a long term savings plan and is set up in a way that discourages early use of the monies in that account. When managed properly and as intended, you won’t touch money in your 401k until retirement. When that time comes, how you manage your 401k becomes even more important to ensure you have enough money to last throughout your golden years. Tips before retirement.

Last Minute Retirement TipsThere are many things to consider when the time comes to exit the workforce. After saving for most of your adult life, it is very important to take the necessary steps to protect your retirement savings and ensure they are used as intended. Your 401k is an integral piece of your retirement plan, so that’s why you need to go great lengths to implement some of these tips. |

| Posted: 17 Aug 2010 05:28 AM PDT A 403b Plan is very similar to a 401K plan. Just as a 401K plan is a retirement plan for individuals, a 403b plan is a retirement plan that is tailored for those people who work for the public educational institutions, hospitals, non-profit or charity organizations, religious organizations or museums. This retirement plan is a tax deferred plan which means that contributions come from pre-tax dollars and are therefore not subject to normal levels of income tax. Why Start a 403b Plan?403b plans are used for many reasons;

How is a 403b Plan Started?If you are interested in starting a 403b plan the first thing to do is ask your employer if they have an established annuity provider. The employer may be able to offer you a few annuity providers to choose from and then you can select from among the ones available and state how much of your salary you would like to have transferred into the plan every month. This is done using a salary deduction form and your employer reports your reduced take-home pay on your W2 form. There are limits on how much you can contribute annually. An individual is allowed to contribute up to $15,500 per year to a 403b plan, but if the plan is employee sponsored the combined contribution can increase to $46,000 with the employer putting in the difference. As of 2010 if you are 50 and over you can add an additional $5500 to your contributions as a catch-up for retirement. What Type of Investments are Eligible?If you want to invest in a 403b plan your funds need to be placed in an annuity product or in a retirement custodian account that is invested in mutual funds. These stipulations are set up by the IRS and must be adhered to. Withdrawing From a 403b PlanThis is a very important consideration and one that you should look into with great interest. Under a Roth IRA there are no penalties for early withdrawal and this feature makes a Roth a good place to save for other milestones as well. However, under a 403b plan you can face some stiff withdrawal penalties especially in the first few years of starting the plan. Tiered interest fines for early withdrawal can start at about 8% and are usually applicable for up to eight years. This means that if the plan is closed after the first year an 8% penalty is deducted but by the eighth year the rate drops to 1%. This is not standard however so you need to find out the stipulations associated with your plan. A 403b plan gives employees of non-profits and public sector organizations the same access to retirement funding as a 401K so they do a great job of leveling the access to opportunities for saving. |

| You are subscribed to email updates from Consumer Boomer To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment

Thank you for commenting on my blog. I will write back soon!